If you’re already using either one of those services, PockeSmith might be a good fit.

PocketSmith integrates with Mint and Xero.

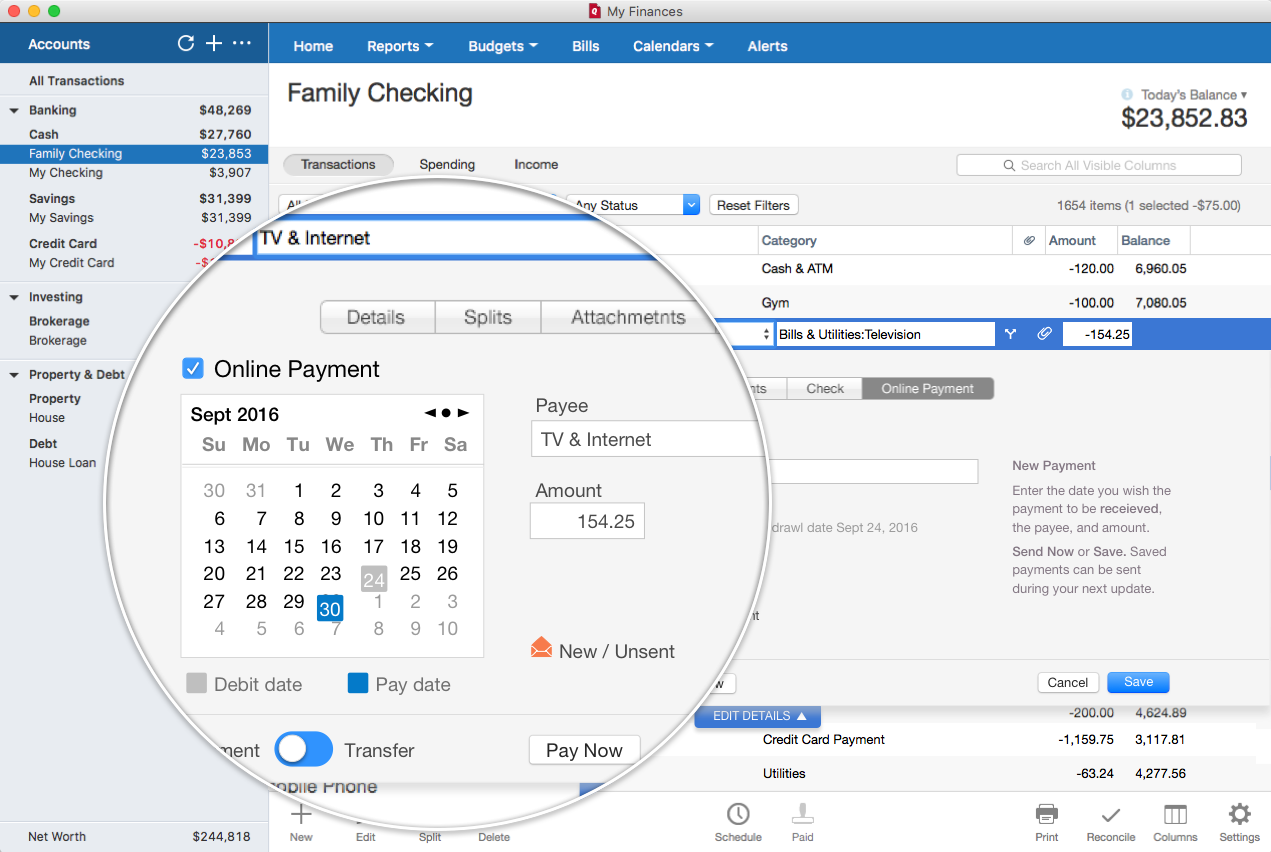

If you don’t want to use Quicken for Mac or run a virtual machine for Quicken for Windows, you’ll need to find some alternative personal financial software. They can still use Quicken for Mac but it is an inferior experience compared to Quicken for Windows. I'd like to have similar reports (by quarter, by year, over time) but grouped by asset class. View spending reports, set a budget, track your bills and. Mac users haven’t been left high and dry by Quicken, though.

#QUICKEN FOR MAC NET WORTH REPORT FREE#

The cash flow statement breaks down your historical and future financial activity by month. ClearCheckbook is a free and easy to use online checkbook register and money management tool. Review collected by and hosted on G2.com. Use reports to track income and expenses. If some of your bills are not online, you can input them manually and again, it will show you a projected account balance based off your input. I also LOVE the fact that you can sync it to your billers, like cell phone services and then you can see them in a calendar so you can see what is coming up due. I also like how you can customize your dashboard so it will show you first what is most important to you at a glance. It also seems like Quicken does monthly releases to include any bug fixes, you can email reports, and it seems just an overall faster and better user experience for things like investments, budget tracking and more. Quicken for Mac also falls a bit short when it comes to investment tools, especially in regard to its lack of automatic cost-basis calculations.

#QUICKEN FOR MAC NET WORTH REPORT WINDOWS#

Its summary view or dashboard shows net worth and. Quicken for Mac still trails Quicken for Windows in ease of use, interface (i.e., navigation), intuitiveness, versatility, and features. My father also uses it for his business as well as personal use. Banktivitys detailed financial reporting shows you the big picture of your finances. Whatever you need it for financially, they have a ton of different packages to choose from. It is one of the oldest budgeting tools around but they have definitely updated the application to be in line with other competitors with 2020. Mint doesn't offer any functions for real estate and small business management. Property & Small Business Management Winner: Quicken. I also love the green bars that show you how far away you are from goals. Quicken does not have alerts except for the weekly spending, investment, and net worth reports. Creating a budget and managing bills, looking at all your accounts in one place, auto-categorizing each purchase, its just so easy. It is so user-friendly and easy to use, even for the most novice of technology-users.

0 kommentar(er)

0 kommentar(er)